49+ can you write off interest paid on your mortgage

At least in most circumstances you can. While rising interest rates may lead to more home improvement projects some homeowners who opt to stay in their current homes may just want to.

Revised By Hohne Hive Bfgnet British Forces Germany

Web Reform caps the amount of mortgage debt for which you can claim an interest deduction at 750000.

. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment.

The limit is 375000 for married couples filing separate. This means when you file your taxes and have to pay a. Web Fortunately you can deduct your mortgage interest as an expense on your Schedule E to lower your rental income and reduce your tax bill.

You must also have a. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. However higher limitations 1 million 500000 if married.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Ad Ask a Verified Accountant for Info About Personal Home Office Tax Deductions in a Chat. Web The write-off is limited to interest on up to 750000 375000 for married-filing-separately taxpayers of mortgage debt incurred after Dec.

Web 4 hours ago2. Review the amount of interest. Web Most homeowners can deduct all of their mortgage interest.

Web You can claim the deduction every year that you make payments on your loan. Web Youre entitled to deduct only the mortgage interest that you personally paid regardless of who received the Form 1098 from the lender. You see in the US mortgage interest is considered tax-deductible.

Web As of the beginning of 2018 couples who file their taxes jointly are only able to deduct interest on up to 750000 of eligible mortgages which is down from 1 million. Web 4 hours agoVerizon Communications VZ 093 easily ranks as the highest-paying Dow dividend stock. Web If your total property is rented out for the entire year you can deduct 100 of the mortgage interest paid on that property.

Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. Create Your Satisfaction of Mortgage. Verizon has increased its dividend for.

Web Your mortgage lender will send you a form called Form 1098 that details the amount of mortgage interest you paid over the year. The benefits of claiming your mortgage interest. However you can only deduct the interest that you paid during that year.

Ad Developed by Lawyers. Its yield currently tops 71. Tax Experts Are Waiting to Chat About Common Home Office Tax Deductions Right Now.

Web Claiming your mortgage interest can be an effective way to reduce your income and increase your deductions. However if your property operates as a. LawDepot Has You Covered with a Wide Variety of Legal Documents.

Proof Of Income Letter Examples 13 In Pdf Examples

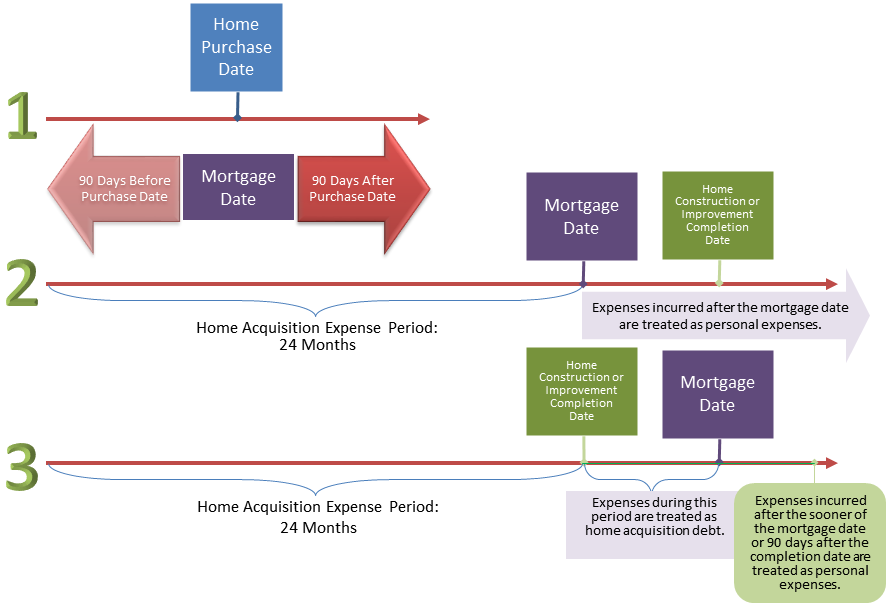

Itemized Deductions For Interest Expenses On Home Mortgages And Home Equity Loans

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

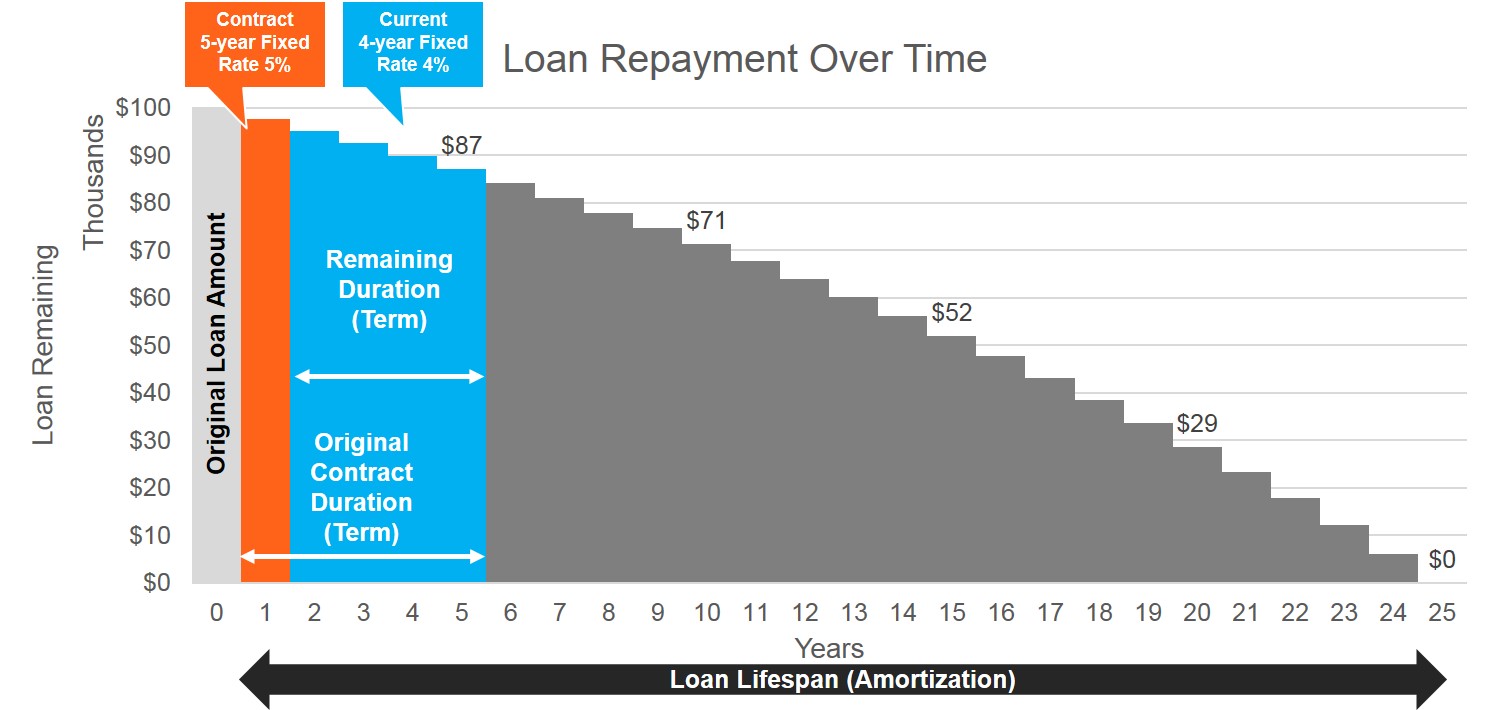

Penalties For Early Mortgage Repayment Prepayment Mortgage Sandbox

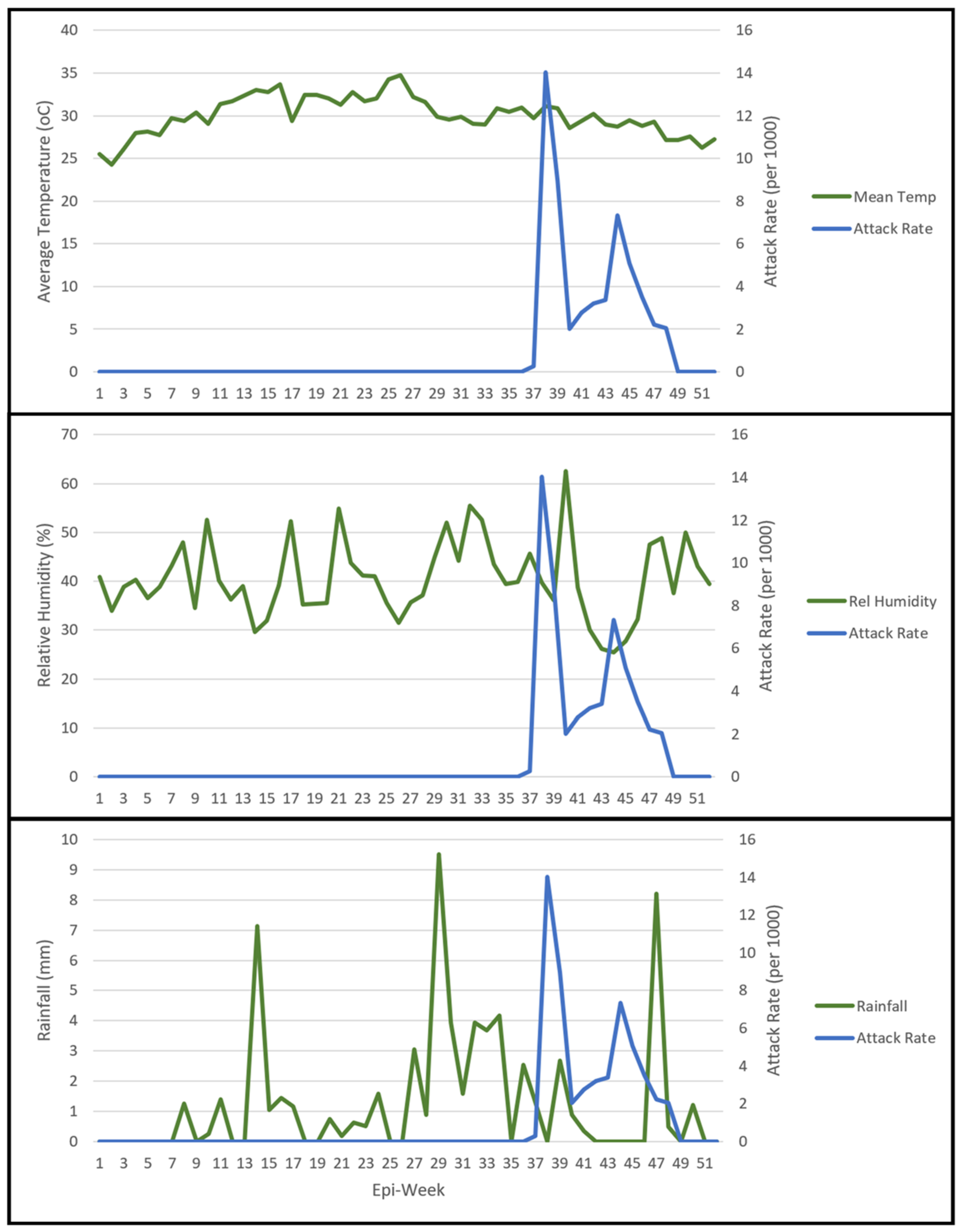

Insects Free Full Text Epidemiological Entomological And Climatological Investigation Of The 2019 Dengue Fever Outbreak In Gewane District Afar Region North East Ethiopia

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Free 49 Budget Forms In Pdf Ms Word Excel

Repair Body Cream White Tea 200ml Sabon Us

Semi Furnished Property For Rent In Miyapur Hyderabad 49 Rent Semi Furnished Property In Miyapur Hyderabad

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

The Trucker Clogs In A Bad Way Direct From Denmark

Is Mortgage Interest Tax Deductible Accumulating Money

89 Insurance Statistics You Should Know Industry

Kaiserslautern American May 29 2020 By Advantipro Gmbh Issuu

Home Mortgage Loan Interest Payments Points Deduction

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

House For Sale In Kasargod 49 House In Kasargod